The coronavirus outbreak has made many things uncertain in the world right now, including the economy. It’s natural that, as uncertainty and anxiety spread throughout the population, instability occurs.

Facing that reality these days is a critical time to take control of your personal finances and get your budget on track. Doing your best to proactively keep track of your personal finances is the best thing you can do for your financial health.

- Reevaluate Your Budget

You may have already had a budget before, but now is a time to reevaluate your spending. First, consider what your essential living expenses are. This likely includes your mortgage payment or rent, your car payments, medical costs, your grocery bill, and other living expenses you can’t do without. This gives you a base for how much you need to spend in a month. Knowing this, you can better plan how much you’re willing to spend on the other items you regularly pay for.

Now take a look at your recurring payments. Is there a better cell phone plan out there? Do you still need all of your app memberships? Streaming services are likely important to you if you are spending a lot of time at home. However, are you using all of them?

- Talk To Your Creditors

You’ve just looked over your budget. How are you doing? Are there payments you know you aren’t going to be able to make? Are there particular bills you need help with? You should talk to your creditors for your large, essential payments first, such as your mortgage lender or the company handling your car loan or credit cards. These companies will typically have programs you can get into during difficult economic times. Discuss your needs with them to see if they can work with you to make your budget more manageable.

- Consider Refinancing Your Mortgage

This will not make sense for everyone, but it may make sense for you. Mortgage rates are down right now. You’ll need to research your individual situation to see if this makes financial sense for you. It could bring down your monthly payments or lower the amount you pay long term for your mortgage.

- Look At Your Federal Student Loans

Currently, federal student loan programs have suspended payments through September 30th, 2020. You can contact your lender to be sure this applies to your situation.

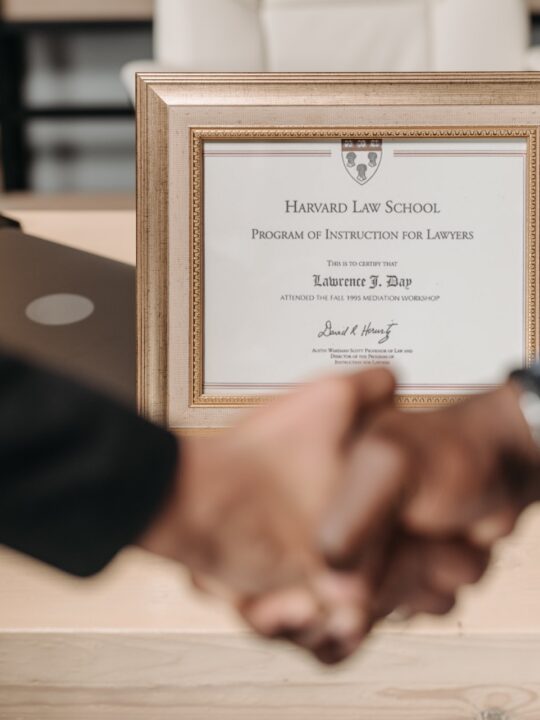

- Learn More About Financial Management

The more you know about managing finances, the better position you’ll be in. While you might not want to overload yourself on financial news–as this can cause stress–learning more about your personal finances can be a wise move. Consider subscribing to business podcasts, downloading software for managing your finances, and reading a few books from the library on how to better consider your current financial health and meeting your long term financial goals. During these uncertain economic times, jobs in the financial sector will become valuable. If you find you enjoy working with your finances, you may consider becoming a CPA. Certified public accountants are always valuable.

- Be Mindful About Your Savings

If you still have income, you’ll want to be allocating this with the future in mind. It’s challenging to make decisions when the economy and stock market are fluctuating. With that in mind, you might consider options like CDs, where there are low interest rates, but the interest rate stays the same.

- Talk To A Personal Finance Advisor

Many people falsely believe that financial advisors are only there to help the wealthy. In fact, people from all income levels can benefit from a personal financial advisor’s help. Discuss your current situation, budget, income, and financial goals with them. They may have insight on programs you could join, savings options you’ve never heard of, or more tips personalized to your situation that could help you thrive now and in the long term.

- Manage Your Stress

This may not sound like a financial tip, but it’s actually an important one. When people become stressed about their finances, it can lead to making worse financial decisions. For example, someone stressed about money may ignore their budget, turn to online shopping to relieve stress, or not want to look into long term savings options.

Be proactive and take control of your personal finances, as feeling more in control of your situation will help. Keep in mind that you aren’t the only person going through this, and you’re doing your best to find your way.