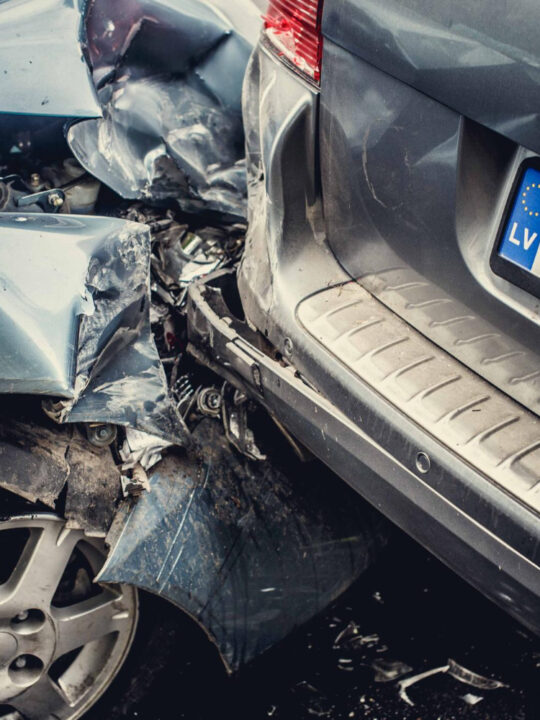

So your friend asked to borrow your car and you thought nothing of it. That’s what friends are for, right? But now you have a problem because your friend just called and told you they were in an accident in your car! You were totally unprepared for this and have no idea what to do. What happens now?

So your friend asked to borrow your car and you thought nothing of it. That’s what friends are for, right? But now you have a problem because your friend just called and told you they were in an accident in your car! You were totally unprepared for this and have no idea what to do. What happens now?

Table of Contents

How does insurance work if someone else is driving your car?

It is a common misconception that insurance applies to the driver of a car, but actually this is not the case. Car insurance applies to the vehicle itself. Your insurance will still apply to your car regardless of who is driving.

Is this a good thing? Maybe. At least you know you have some insurance on your vehicle. But don’t be fooled into thinking that your friend’s great car insurance will take care of any accident they are involved in, and remember, if someone else is driving your car and gets into an accident that your insurance has to pay out on, YOUR rates will be the ones to increase.

Will you be held liable for damages or injuries caused by another driver?

The good news is if the other driver was at fault for the incident, there is probably not much you have to worry about, as their insurance will be on the hook. You may have a problem, however, if the friend driving your car was the one at fault.

Your insurance will cover any property damage arising from the accident. If you don’t have collision coverage, you will have to pay to repair your car’s damage yourself and remember that you’ll also have to pay your deductible.

If the accident caused injury to the driver or passengers of the other vehicle, your insurance may need to pay for their medical bills beyond personal injury protection coverage. If this still isn’t enough, then your friend’s coverage may be added on to help cover the costs, which can of course be substantial. The average bodily injury claim is over $15,000.

The real problem occurs if your friend has no insurance. Maybe they don’t usually drive, or they’ve let their car insurance lapse. This is potentially a big problem for you because the money needs to come from somewhere, and once your insurance limits are used up, there is no other insurance company as a backup. Therefore, since it was your car, you may be held liable for the remainder of the money, and you don’t want to find yourself on the wrong end of a lawsuit brought by an injury attorney in DC or elsewhere.

How to Protect Yourself From Unexpected Costs and Headaches

The takeaway from all of this is that you need to be very, very careful who you lend your car to. Especially if your friend has no insurance of their own, you may want to think twice about allowing them to borrow your vehicle, and therefore your car insurance, as any financial consequences for an accident may fall on you. Remember that medical bills resulting from accident injuries can quickly increase to astronomical levels that you probably would struggle to pay for if you’re found responsible. Even if you get lucky and there are no injuries, an accident caused by your friend can and will increase your car insurance rates and impact you financially.