Many factors go into determining your car insurance rates. Learn about the most common rating factors and how they affect your premium.

Many factors go into determining your car insurance rates. Learn about the most common rating factors and how they affect your premium.

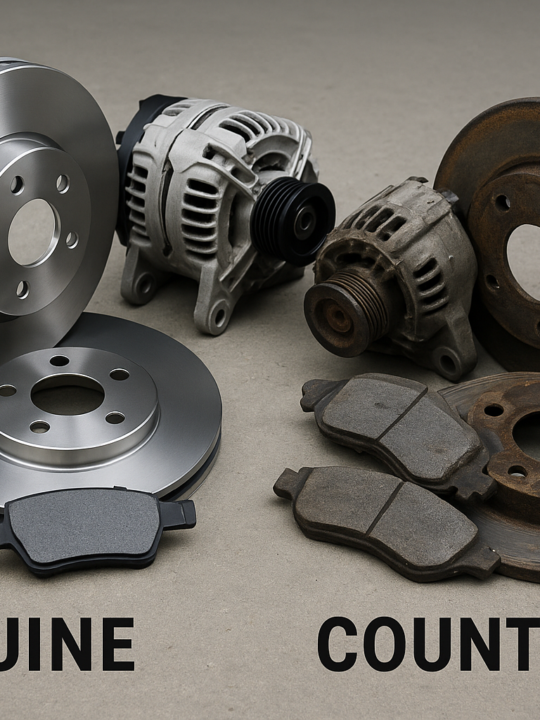

Your choice of vehicle can significantly affect the cost of your car insurance. Luxury vehicles and sports cars often cost more to insure because of expensive parts and labor.

Table of Contents

Comprehensive Coverage

A comprehensive car insurance policy reimburses you for damage caused by non-collision events like falling objects, fire, or theft. It also pays for weather-related incidents like flooding or hail that may impact your vehicle. Compared to liability-only policies, comprehensive auto coverage can provide reimbursement for repairing your vehicle up to its actual cash value minus your deductible.

The decision to include this type of coverage depends on your situation, including the age and value of your vehicle and whether you live in an area with a high rate of natural disasters or crime. It also depends on your finances since you’ll be responsible for paying your comprehensive deductible before your insurer covers any repairs.

If you opt for a higher deductible, your premium will be lower. However, be sure you have the money to pay your deductible if you need to make a claim. You should also factor in the additional costs associated with rental reimbursement coverage, which some comprehensive insurance policies include.

Collision Coverage

Collision coverage pays to repair your car if it’s damaged in an accident with another vehicle or stationary object, such as a light pole or parking meter. It covers damage regardless of who was at fault in the crash and can help pay for a rental car if needed. It’s usually less expensive than comprehensive coverage and is required by most lenders or lease companies if you’re financing or leasing a car. Go to www.carinsurancecheap.net to learn more about its advantages.

It’s also important to understand that collision and comprehensive insurance are not the same—they both cover physical damage to your vehicle, but comprehensive covers events outside of a driver’s control, like extreme weather or theft. Many drivers choose to have both collision and comprehensive to create a “full coverage” policy that can bolster liability coverage. It’s also a good idea to consider the value of your vehicle and its current market value when choosing how much collision coverage you should have. This is because the maximum your insurer will pay for a covered loss equals your car’s actual cash value minus your chosen deductible.

Liability Coverage

Liability car insurance protects you against the financial costs resulting from accidents you cause. It pays for the other person’s bodily injury and property damage and covers your legal fees if you get sued.

Most states require liability car insurance, which you’ll need if you lease or finance your vehicle. However, if you own your car outright or can easily afford to replace it in the event of an accident, then you might not need full coverage.

Other types of optional car insurance include personal injury protection and medical payments coverage for you and your passengers, uninsured/underinsured motorist coverage, and gap coverage (the difference between the actual value of your car and what you owe on it). The specifics vary by policy. Ask your agent for details about what each type of coverage includes. Reviewing your policy at least once a year is also a good idea. That way, you can ensure the limits on your coverage are appropriate for your lifestyle and budget.

Uninsured Motorist Coverage

Many drivers choose to drive without car insurance or purchase only the minimum amount required by law. In some states, about one in eight drivers are uninsured. Uninsured motorist coverage (UM) helps you pay for damages from an accident caused by someone who does not have auto insurance or whose policy limits are below the cost of your damages. It is generally bundled with liability coverage and carries the same policy limits. The higher the limit you choose, the more expensive your premium.

In addition to UM, some insurers offer underinsured motorist coverage (UIM) to cover the difference between the other driver’s property damage liability limits and the actual cost of your damages. UM and UIM are relatively inexpensive add-ons to your policy that could save you thousands if an uninsured or underinsured driver hits you. Most insurers also include no-fault insurance that pays promptly, regardless of fault, for medical/health expenses and economic losses (like lost wages) up to a set amount per person.