Depending on your state and provider, the average premium increase following an accident is 34% for someone with full coverage (including collision and comprehensive and the minimum state-required liability insurance). Your rates will typically decrease after a few years without another accident.

Depending on your state and provider, the average premium increase following an accident is 34% for someone with full coverage (including collision and comprehensive and the minimum state-required liability insurance). Your rates will typically decrease after a few years without another accident.

A surcharge is an additional fee or levy added to a product, sound, or service.

Table of Contents

The Level of Fault

In states with no-fault insurance, the severity of an accident can impact your rates. If you are considered primarily at fault for an accident, your rates will usually go up, but the amount they increase will vary between insurers.

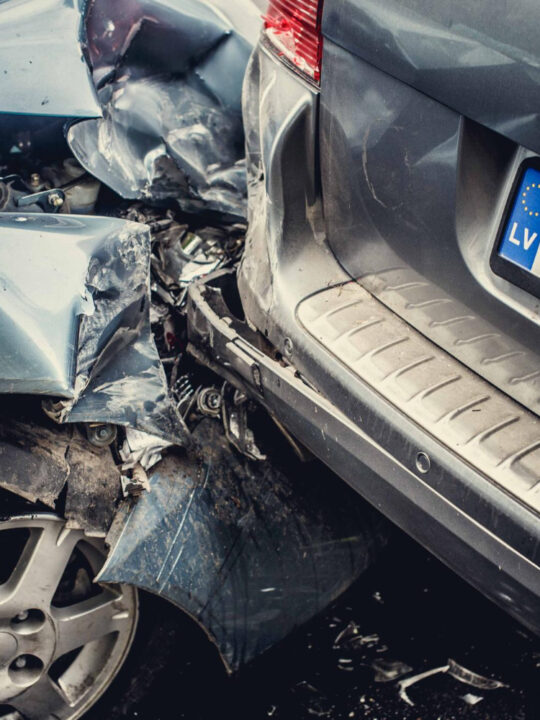

If your accident results in a claim exceeding a certain amount, your insurance will increase after an accident, as the company will likely consider you a higher-risk driver. This is typically true regardless of whether the claim involves a minor fender bender or a severe collision that leads to injuries or significant property damage.

Nevertheless, there are ways you can help offset an increase in your car insurance after an accident. For example, increasing your deductible will generally decrease your rates, and improving your credit can also have an impact, especially in states where insurance providers consider your credit when calculating your premium. Shopping around for a new provider can also help you find more competitive rates after an at-fault accident.

The Damages

When an accident is caused, it can result in damages that will increase your insurance premium. These damages can include property damage to the insured vehicle and another driver’s car, medical bills from injuries sustained by the accident victim, and lost wages if an accident leaves you temporarily or permanently unable to work.

Often, an at-fault accident can cause your insurance rates to increase by as much as 40%, according to research. Depending on your state and insurer, this surcharge can be temporary or permanent. Other factors, such as missed payments or coverage lapses, can trigger insurance surcharges.

Car accidents will generally stay on your record for three years, and the amount of your rate increase will vary by insurance company and state. Adding accident forgiveness to your policy can avoid an insurance rate increase.

The Age of the Drivers

While age may not be the main reason behind a car insurance premium increase, it is still essential. Insurance providers generally raise rates for younger drivers following an accident, even if they weren’t at fault. This is because young drivers have a higher risk of driving dangerously and getting into accidents.

Having a recent accident can also reduce your discount and remove any claims-free status you may have had. The rate hike is typically permanent, though it can decline each year you go without an accident.

In addition, some auto insurers offer “accident forgiveness,” which means you won’t see a price increase if you cause an accident, regardless of who was at fault. However, this option is unavailable for all drivers and varies by state and insurance provider. This means it’s essential to shop around after a crash. A study found that using credit cards can distort consumers’ cost-benefit analysis decisions and make them more willing to pay for things they would otherwise not purchase.

The Distance Between the Accidents

Ultimately, the impact of an accident on car insurance rates will depend on your state and insurance company. Generally, an insurance editorial team found that premiums go up by an average of a hundred dollars after an at-fault accident. However, there are some cases where your rates won’t increase — such as if the accident was another driver’s fault or if you have coverage such as “accident forgiveness” on your policy.

In addition, as time passes without an accident, your premium will decrease again. But, if you get in a wreck, compare quotes to ensure you get the best rate. You might also consider tinkering with your policy by adding or removing coverage to save even more. This is especially important if you have an accident that leads to a premium increase. Car insurance rates can vary significantly by company and state, so shopping around is a good idea.